You might be curious about the requirements for a career as a financial consultant. Be sure to do your research on the qualifications, work culture, and salary of your ideal candidates before you apply for a job. Monster.com is a free job site that allows you to post your job vacancy. Here are some suggestions for creating a compelling job description for financial consultants. You will attract the best candidates by creating a compelling description.

Qualifications

A bachelor's degree in finance, or a closely related field, is the minimum qualification for financial consulting positions. Additionally, certification is a great way to improve your career prospects. Earning a master's degree is also an asset, as it strengthens resumes and demonstrates advanced academic learning. Learn more about the different degrees and credentials you will need to be a part of this rapidly growing industry. There are many qualifications that can be used to become a financial consultant. You need to make sure you read the job requirements.

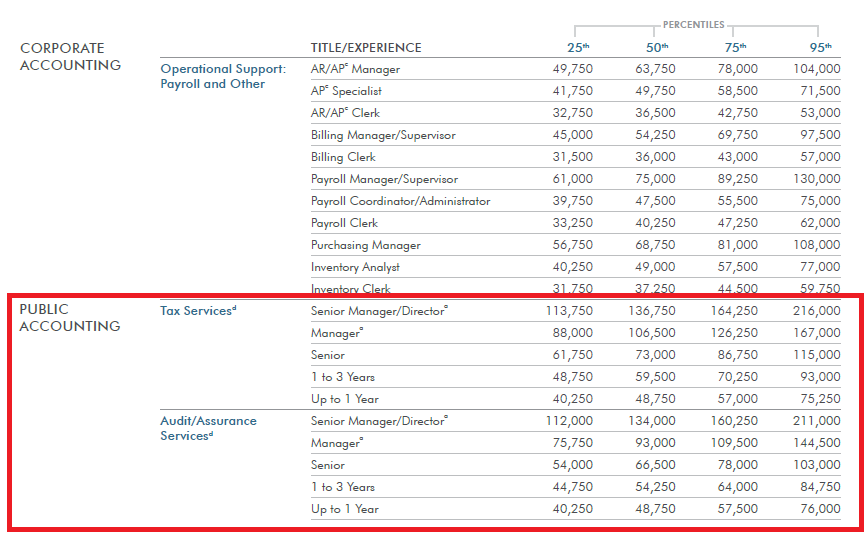

Salary

Financial consultants address issues related to taxes and accounting as well as risk management and monetary operations. They are also called management consultants. Their roles are covered by larger audit firms. They use financial data in order to provide solutions to clients and make plans to improve business processes. The average salary for a financial consultant is different in each city. These five jobs often pay more that the national average.

Work environment

The career of a financial consultant is rewarding but can also be challenging. As a financial advisor, you will have to analyze data and create plans for clients. Also, you'll need to be able think critically in order to analyze a client’s financial situation and make suggestions that can improve it. A financial consultant may research various financial products and services for clients. Networking skills are also important.

Requirements

A bachelor's level in finance is a good starting point for anyone who wants to be a financial adviser. Although you don't need to be licensed to trade securities, it may be beneficial for your career. Additionally, you can obtain additional certifications, which may bolster your resume and enhance your earning potential. Depending on what type of financial consulting you hope to pursue, you may also want to take introductory economics classes.

Salary range

According to the U.S. Bureau of Labor Statistics' May 2011 Occupational Employment Statistics, the national median annual wage for financial professionals was $66,580. The lowest 25% of financial professionals earned $43,160, while the highest 10% earned more than $1118,880 annually. Simply Hired reported in June 2012 that senior financial consultant salaries averaged $104,000. Consultants make money by managing client assets and collecting fees for services such as financial planning.

FAQ

What is the difference in a consultant and advisor?

An advisor is someone who provides information about a subject. A consultant can offer solutions.

A consultant works directly with clients to help them achieve their goals. An advisor advises clients indirectly through books, magazines, lectures, seminars, etc.

What qualifications do you need to be a consultant?

It's not enough just to have an MBA degree; you must also demonstrate experience working as a business consultant. A minimum of two years' experience in consulting, training and/or advising a major company is necessary.

Your experience in strategy development projects requires that you work closely with senior managers. This would require you to be comfortable with presenting ideas and getting buy in from clients.

Additionally, you will need to pass a professional qualification such as the Chartered Management Institute Certified Management Consultant (CMC).

What type of contracts are available to consultants?

Most consultants sign standard employment deals when they're hired. These agreements include details such as how long the consultant will stay with the client, what he/she can be paid, and other important information.

Contracts may also include details about the specific areas of expertise that the consultant is going to be focusing on as well as how they will be compensated. An agreement could state, for example, that the consultant will offer training sessions, workshops and webinars.

Sometimes, the consultant agrees to do certain tasks within a given time frame.

Many consultants sign independent contractor agreements in addition to the standard employment agreements. These agreements allow the consultant work on his/her own but still receive compensation for his/her efforts.

What can I anticipate from my consultant

When you choose your consultant, they should respond within a few working days. They will typically ask for information about the company, such as its mission, goals. products and services. budget. After that, they will send you a proposal detailing the scope of work, expected time frame, fees and deliverables.

If everything goes as planned, then both parties will agree to a written contractual agreement. The type of relationship between them (e.g. employer-employee or employer-independent contractor) will determine the terms of the contract.

If all goes according to plan, the consultant will begin working immediately. The consultant will have access your internal documents and resources. Additionally, you'll have access their skills and knowledge.

However, don't assume that just because someone is a consultant that s/he knows everything. To become an expert in any field you consult, it takes practice and effort. Do not expect your consultant to be an expert in every aspect of your business.

What are the benefits of consulting?

As a consultant, you can usually choose when you work and what you work on.

This means that you are able to work from wherever you're at any time.

You also have the freedom to change your mind at any time without fearing losing your money.

Finally, you are able to manage your income and make your own schedule.

Do I really need legal advice?

Yes! Consultants often create contracts with clients without getting legal advice. This can create problems down the line. For example, what happens if the client terminates the agreement before the consultant's completion date? What happens if your consultant doesn't follow the contract deadlines?

It's best to consult with a lawyer to avoid potential problems.

Statistics

- "From there, I told them my rates were going up 25%, this is the new hourly rate, and every single one of them said 'done, fine.' (nerdwallet.com)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- 67% of consultants start their consulting businesses after quitting their jobs, while 33% start while they're still at their jobs. (consultingsuccess.com)

- On average, your program increases the sales team's performance by 33%. (consultingsuccess.com)

External Links

How To

How to find the best consultant

The first thing to do when looking for a new consultant is to ask yourself what you want from him/her. Before you start looking for someone to work with, it's important that you know your expectations. You should make a list of all the things you need from a consultant. This might include skills such as project management, professional expertise, communication, availability, and technical skills. Once you've listed out these requirements, then you may want to consider asking some friends or colleagues who they would recommend. Ask your friends or colleagues about any negative experiences they have had with consultants, and compare their recommendations with yours. If you don't have any recommendations, try doing some research online. You will find many websites such as LinkedIn, Facebook Angie's List, Indeed and Indeed where people can leave reviews about their past work experiences. Consider the ratings and comments of other candidates and use these data to start your search for potential candidates. Finally, once you've got a shortlist of potential candidates, make sure to contact them directly and arrange an interview. In the interview, discuss your needs and ask them for their suggestions on how you can achieve them. It doesn't really matter if they were recommended; as long as they understand your business objectives, they will be able to show how they could help you achieve them.